Why is Now the Best Time to Buy a Home?

Guest post by: Rick Jarvis, 30+ year Realtor and Founder of the One South Realty Group

"The best time to plant a tree was 20 years ago. The next best time is today." – Anonymous

What is Housing?

There was a time when housing was just housing.

It wasn’t analyzed with charts and graphs using predictive algorithms to project pricing in an attempt to show future returns. Up until maybe the early 2000s, housing wasn’t so much an alternative investment to indexed funds or even individual stocks, it was just something you did because you needed more space and you wanted to settle down.

You saw the cute house with the white picket fence and you imagined yourself living there. Perhaps it was some extra grass for the dog or it was the extra bedroom for the nursery, or maybe it was just the feeling of finally being in control of your own destiny, but buying a home was a statement that you were on a path to independence and stability.

Now, instead of looking at housing as an asset you were going to own for a decade or more (my parents lived in the same house for 50 years, not kidding), we look at housing as something that needs to be timed, like 1,000 shares of Apple or Amazon, and we need to sell when prices are up and buy when prices are down.

Somewhere along the line, we lost sight of the fact that a home is one of the most fundamental investments someone can make in their financial lives, and all of the pricing information that is now available about the housing market (which seems to change almost daily, btw) seems to have distracted us from that fact.

It is unfortunate because we have gotten away from asking whether or not it is a good time to buy from a personal perspective, and now ask whether it is a good time from a market perspective.

If you're ready to take that personal leap into homeownership, now is the perfect time to explore quality custom homes by Keel Custom Homes – your trusted custom home builder in Richmond, VA.

Disclaimer: I’m a Realtor

Now, I do feel as if I need to disclaim my position as a Realtor.

It is true that I am in the transaction business and if no one sells or buys, it is difficult for me to make a living - so you can apply whatever conflict of interest factor you would like to my observations. ‘Of course he is going to say yes, it is his job to say yes!’

But I think it is also important to note that in addition to being a 30+ year Realtor, I am also a property owner, and have been so for the same amount of time. And even as prices and rates have risen sharply in the past several years, I have continued to acquire properties for reasons I will discuss below.

So, Is It a Good Time to Buy a Home?

Back to the question at hand – is it a good time to buy a home?

The answer is generally a very strong ‘yes,’ but with a few caveats.

I feel it is appropriate to acknowledge that for everyone, buying is not always the right idea.

If you are getting ready to move to a new city, or you have an uncertain job situation, or maybe a likely change in your familial status, or if you have a parent or sibling who might be moving in and you are not sure how much space you need, then buying might not be the best option. When your need is fluid, the flexibility offered by renting may make more sense because ownership does require a commitment.

But excluding the obvious exemptions, buying into this market, even at these prices and rates, is not the bad decision that many ‘experts’ would have you believe.

Why? Because the market is likely to continue to move away from you if you are a tenant –– meaning that prices are likely to continue to rise in our region at a rapid pace, especially once the election season is over.

Why Buy Now?

So why now? Why buy a house after the prices have nearly doubled since 2020 and rates are up close to 3X?

Because there are more people seeking housing than there is to go around, and that is unlikely to change for quite a while.

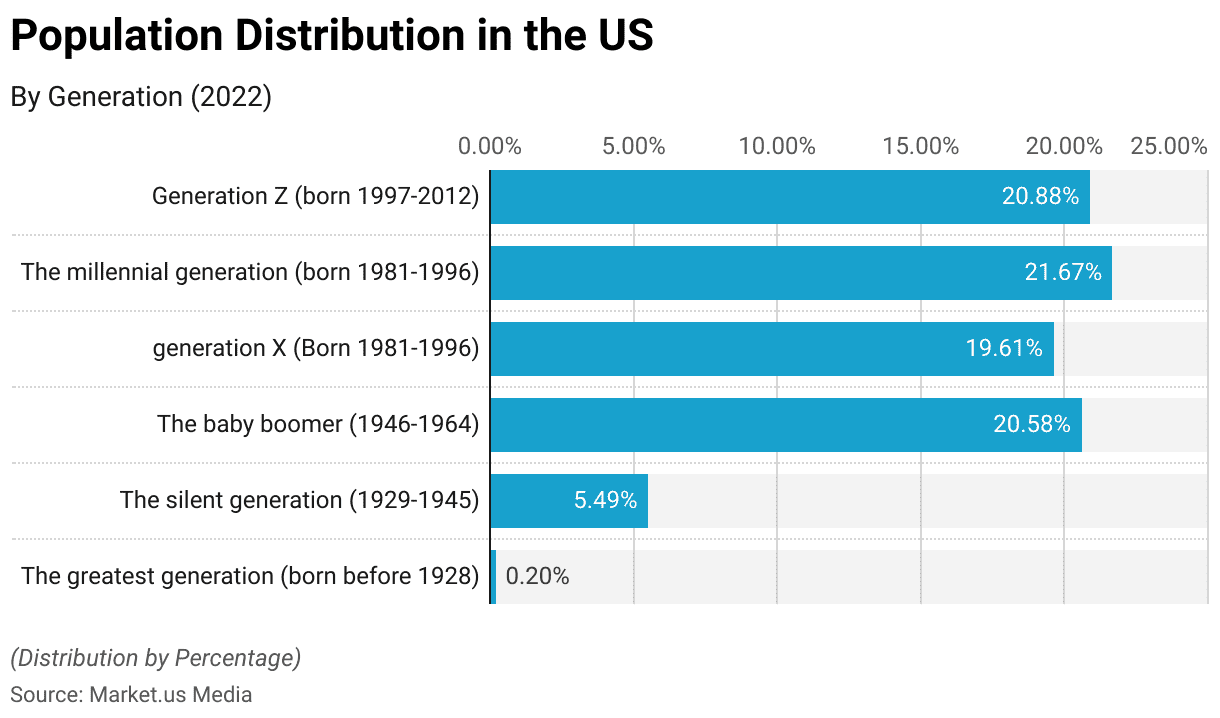

Population Distribution in the US

Demand is up, and supply is down for 4 primary reasons:

Household formation is increasing as the largest group of 30-somethings in U.S. history enters prime homebuying years.

Inbound migration to our region is high.

Development costs and regulations constrain new home inventory and make it expensive to build.

Many homeowners with low mortgage rates are keeping existing home supply constrained.

When demand outpaces supply, prices rise, and those conditions will exist for the foreseeable future.

But Rates Are High – Isn’t That Bad?

What about the high rates? Shouldn't you wait until they come down? I don't think so.

One of the oldest adages about rates is that shrewd investors buy when rates are high and sell when they are low – which is exactly the opposite of what amateurs feel to be the best practice. Low rates lead to purchasers being able to afford more, and it tends to push prices higher. So buying when rates are elevated generally means lower competition for the asset, which leads to better terms, and generally better pricing.

Remember, the price you pay is fixed, but the rate at which you can finance it tends to drop over time.

Timing the Market is a Fool’s Errand

So if you really want to ‘time’ the market, right now is actually one of the better times to be a buyer since the beginning of the Covid inspired Great Migration of 2020.

Inventory is up from all time lows (although still nowhere near the highs of 2008 - 2011) and the election uncertainty has tamped down demand (as presidential elections always seem to do.) And with rates likely to trend down in the coming 6 - 12 months, buying now with fewer competitive buyers means more of a buyer's market than it has been in several cycles – and thus the ability to strike a better deal.

And yes, if rates come down, you can refinance to a lower rate once inflation is finally tamed and the mortgage spreads (hopefully) return to more historical norms.

But even if you could predict interest rates (which no one can), it gets away from the central point: ownership is better than being a tenant for the large majority of people and treating housing like a stock or mutual fund is not really what buying a house is all about.

Buy for your reasons, not market reasons.

Summary

At the end of the day, the pressure on housing prices is still robust and will remain so for the better part of a decade as the largest group in our population moves into their 30s. All the while, we are continuing to restrict the construction of housing, especially at the more affordable end of the spectrum.

High demand and low supply are the constants, and have been so ever since we moved on from the 2008 credit-fueled bubble rise and collapse. And as long as mortgage underwriting stays remotely constant, we are in for more of the same – demand well exceeding supply.

Buy what you can afford and get in the game.

Time is your friend. Timing is your enemy.

About the Author – Rick Jarvis is a 30+ year Realtor and investor, Founder of the One South Realty Group (powered by Samson Properties) in Richmond, VA. One South is an 80-agent brokerage specializing in development, infill, and representing Richmond’s most reputable and innovative builders, such as Keel Homes.

Get started building your dream home!